*NEW FEATURE* The "120" Rule: Minimum Earnings or Hours Averaging & Pay Period Calculations

Tātou Office App is now equiped with settings and calculations that help organisations manage Employee weekly earnings or hours top ups where minimum hours or minimum earnings are averaged across multiple weeks. The “120” rule most notably applies to RSE and PALM Scheme workers, and requires employers to pay workers based on minimum 30 hours average per week, or the equivalent earnings at 30 hours per week.

Check your countries local rules before and after enabling this feature to ensure calculations available are in line with your obligation to any employees affected by these rules.

Release Features

Employee Profile Settings:

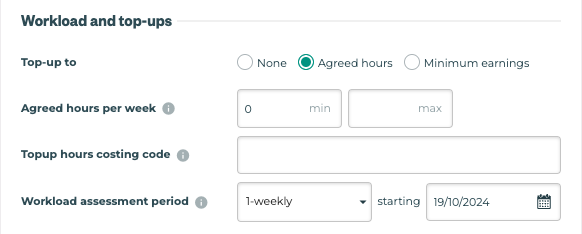

This feature allows Organisations to enable employee specific setting where Employers are contractually required to top an Employee up to either Minimum Earnings or Minimum Hours, and allows users to set the applicable averaging timeframe as defined by your local regulations.

Default settings after release will be:

Top-up to: NONE, unless values defined prior to the release

Workload assessment period: 1-weekly

This can be set to a set 1, 2, 3, or 4 week averaging window

Workload assessment period: starting - the start date of the pay period prior to release

Start Dates selected are restricted to Pay Period Start Dates, however they can be backdated.

Pro Tip: To quickly implement updates to employees who require these settings. Admin users can either use the Tātou Office App’s Bulk Import or Bulk Edit Feature.

Pay Period Calculations

Employment Period Settings will take effect on any OPEN Pay Period, and any required top ups will be reported only in pay periods where top-ups are required.

Partial Week Pro Rating

For Employees with Employment Period Start Dates that are not the first day of a Pay Period, Tātou will calculate Top-up potential based on prorated values for the partial week. This same rule applies to employees who leave before the last day of the pay period.

The availability of these calculations and features may be restricted depending on an organisations payroll processing and documentation used. Examples include:

Organisations who are using Timesheets or Payroll Legacy Reports for payroll

Organisations who have employees with variable pay period start dates

Workload Dashboard

The Workload Dashboard has been added as a tool for managers to review hours worked and manage risk around underworking employee’s who require averaged weekly minimum hours or earnings. Once Employee Profile information is updated, this dashboard will show underworked and overworked totals by Pay Period for the date range filter.

Data is only available for dates in which pay periods have been created.

How Will This Affect You?

If your Organisation is currently using the Top up to Minimum Hours or Earnings, these setting will continue calculating weekly as before.

If your organisation will be using this feature, updating Employment Periods will update the Workload Dashboard reporting and Pay Period Calculation will take effect.

How To Prepare Your Account?

The number of employees affected and type of Top up to Minimum value may determine which method works best for your team.

1. Review Tātou Employment Period Improvements

If you have not had a chance to look through the updated Employment Period Feature, take this time to review the release notes here.

Ensuring Employment Period Start and End Dates accurately reflect employment agreements will ensure these new Top Up to Minimum Hours or Earnings Calculations accurately prorate values when an employee’s start date does not fall on the first day of the Pay Period. If you have any questions or would like any support reviewing this information send us an email at support@tatou.app

2. Tātou Attendance Feature

If your Organisation is not already using Tātou’s Attendance Feature, enabling and using this feature will ensure absences that should contribute to agreed minimum hours or earnings are taken into account when calculating top up values (e.g. public holidays, sick leave, annual leave, etc.)

If your Organisation is already using Tātou’s Attendance Feature, ensure the Absence Reasons have been edited to contribute to the applicable minimum value or gross pay so these values can be taken into account in the calculations for this feature.

For more information on the Tātou Attendance Feature click here.

Absence Values are calculated based on the Employee’s hourly rate and the hours entered for the absence. This is a know limitation of the calculations within Tātou, and must be accounted for when using this feature for Minimum Earnings Top Ups and Leave reporting.

3. Update Employee Profile → Employment Period Settings

Define Assessment Period Start Dates based on Groups of Employees who started within the same Pay Period Week.

Bulk Edit:

Filter to Applicable Recruitment Type (e.g. RSE, PALM, etc.)

Select All Employees that require update

Bulk Edit

Update Details

Save

For Organisations Using Minimum Earnings Top Up - Bulk Edit is only appropriate for Employees whose hourly rate and minimum hours are Applicable

Bulk Import: Top Up to Minimum EARNINGS

Reporting Menu → Exports → Employee Export

Review/Filter to Employees who are covered under the applicable regulations

Edit/Check Columns

current_employment_period_start_date

Ensure this date is the actual start date for their current employment period

current_employment_period_agreed_hours_min

This can be the hours used to calculate minimum earnings

current_employment_period_workload_topup_typeValue =

minimum_earnings

current_employment_period_workload_period_start_date

Must be the first day of a Pay Period (YYYY-MM-DD)

current_employment_period_workload_period_durationAccepted Values Include:

1234

current_employment_period_minimum_earnings

Bulk Import: Top Up to Minimum HOURS

Reporting Menu → Exports → Employee Export

Review/Filter to Employees who are covered under the applicable regulations

Edit/Check Columns

current_employment_period_start_date

Ensure this date is the actual start date for their current employment period

current_employment_period_agreed_hours_min

This can be the hours used to calculate minimum earnings

current_employment_period_workload_topup_typeValue =

agreed_hours

current_employment_period_workload_period_start_date

Must be the first day of a Pay Period (YYYY-MM-DD)

current_employment_period_workload_period_durationAccepted Values Include:

1234

current_employment_period_topup_to_agreed_hours_costing_code

4. Pay Periods & Payroll Reporting

Calculations are based on your Organisations Pay Period Settings. As such, any Top Up Settings added must remain linked to Pay Period Start Dates.

See Examples:

Fortnightly Pay Period that runs Thursday thru Wednesday:

current_employment_period_workload_period_start_datemust be a Thursday, but can be either the first or second Thursday in that Pay Period

Weekly Pay Period that runs Monday thru Sunday

current_employment_period_workload_period_start_datemust be a Monday

Organisations using Payroll (legacy) and Timesheet Reports for their weekly payroll will not be able to report top up values calculated in Tātou. Contact us at support@tatou.app if you would like to review reporting options.

If your Organisation has Pay Periods outside of Tātou that start on different days of the week, enabling this feature may result in data that is inaccurate. For that reason, this feature should only be used for Employees whose pay period reflects the pay period start dates within Tātou.

5. Payroll Report Summary Rows

Pay Summary Rows can be added to your custom payroll report. Check with your Payroll provider to ensure codes are set up, and contact us if you need any help updating your report.