22 January 2026

What’s Changed?

NEW FEATURE: We’ve got some exciting news for customers who’ve requested Allowances, Bonuses and Reimbursements to be captured in Tātou.

Employee Expenses

Tātou has expanded the Expenses that can be tracked on a Job to Employee Expense. These are Expenses that contribute to Payroll in addition to Job Costings, and may or may not be included in Invoicing.

This feature is turned on by request. Get in touch to learn more support@tatou.app

Expense Types: Allowance vs Reimbursement

Seek professional advice to ensure reimbursements and allowances are set up correctly. They are treated differently for tax and employee entitlements. Without clear agreements, records, and evidence of the business purpose, payments intended as reimbursements may be reclassified as taxable allowances, with wider implications.

Type | Allowance (includes bonuses due to same rules) | Reimbursement | |

|---|---|---|---|

Definition | Set extra payment to cover expected costs or compensate for work conditions/skills. Employee doesn’t have to prove exact spend. | Additional earnings aka Bonus, tied to pre-agreed performance criteria (speed/quality) or undefined at the employers discretion. | Paying an employee back for actual work expenses they incurred; usually supported by receipts or a reasonable estimate. |

Example usage |

|

|

|

Included in pay earnings |

|

|

|

Included in invoicing |

|

|

|

Incur additional costs % |

|

| ❌ |

Impact minimum earnings top-ups (NZ only) |

|

| ❌ |

How do I use it?

Required Action to enable Employee Expenses

This feature is turned on by request. Get in touch to learn more support@tatou.app

Tātou Office App

Refresh Browser after Release > Add Employee Expenses

Tātou Field App

Update Tātou Field App

Payroll Reporting

Update Custom Payroll Report

Employee Expenses must first be added in Tātou Office App. When creating these expenses Admin have the ability to SHOW IN FIELD APP, which provides flexibility to start using the feature without rolling it out to the Field App to start.

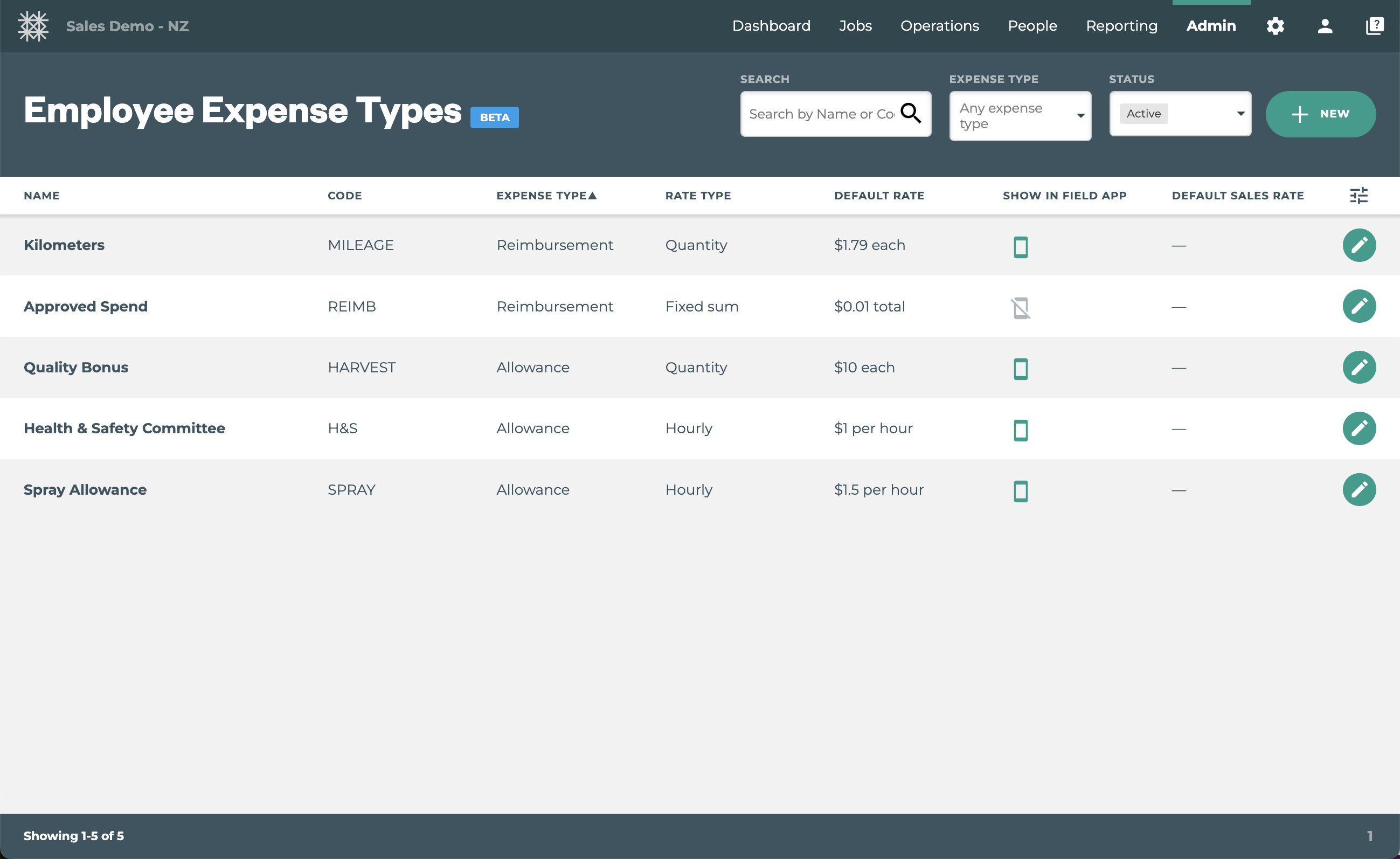

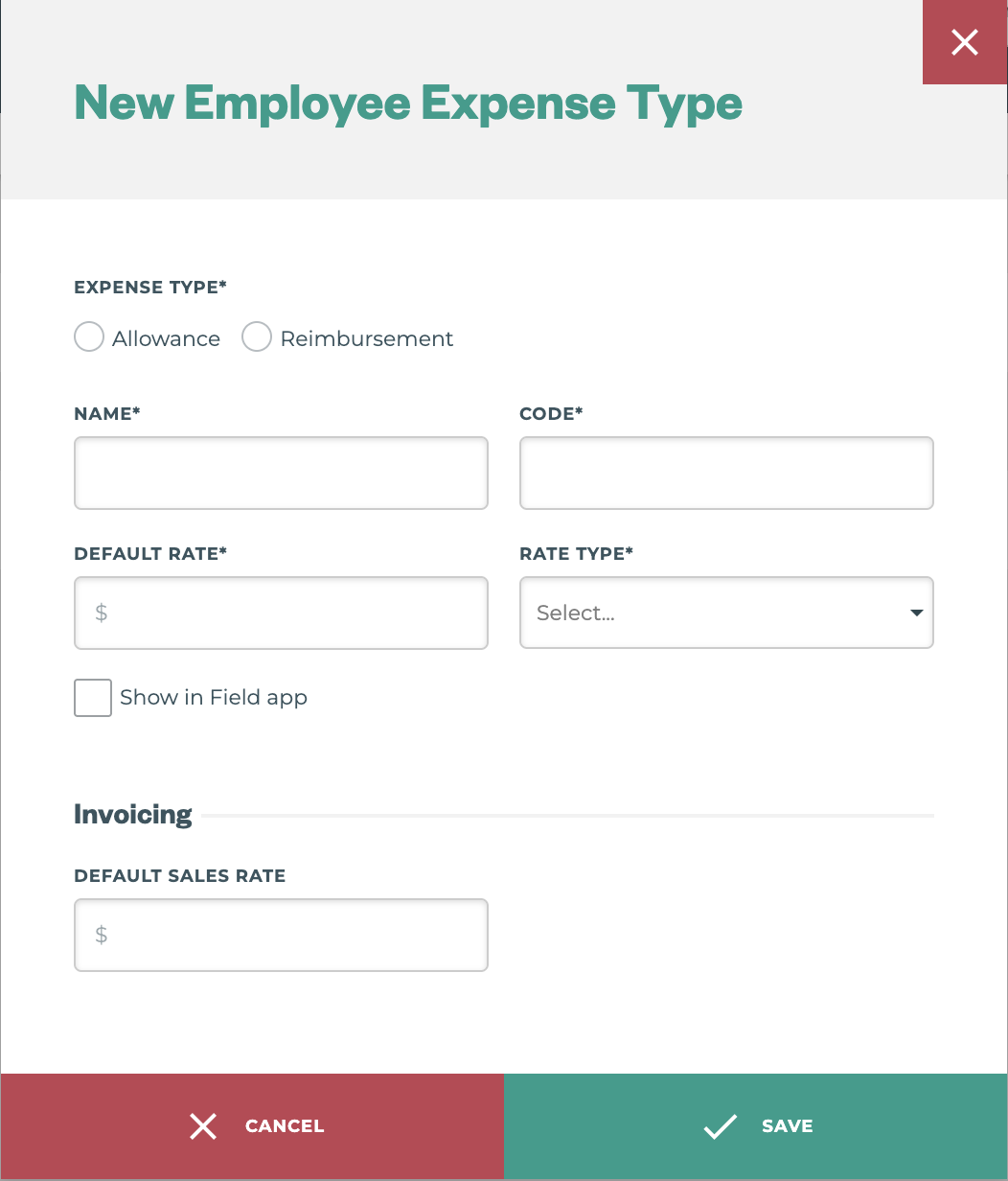

How to…Add Employee Expenses in Tātou Office App

Click the + New button →

<-

<-Fill in the popup window details

Click the Save button

Match Name/Code to Payroll System Values

Default Rate must be greater than $0.00 - If an employee expense does not have a set value you can add $0.01 which can be edited later.

How-To Track Employee Expenses

How to…Add Employee Expenses to a Job in Tātou Field App

Make sure Tātou Field App is Updated

Reload Data

Track Job as normal

On Pricing Screen:

Tap the Edit Timesheet →

<-

<-Tap Add Expense

Select Expense from the drop down list

Tap to add Quantity

Tap the Confirm button to Save

Notes on Employee Expenses Defaults

Employee Expense Rates are only editable IF the employee has Set Rates Permissions

Quantity will auto populate based on the Rate Type Associated with the Employee Expense - but can be edited in the event that the Quantity does not match the automated value pulled from the Job.

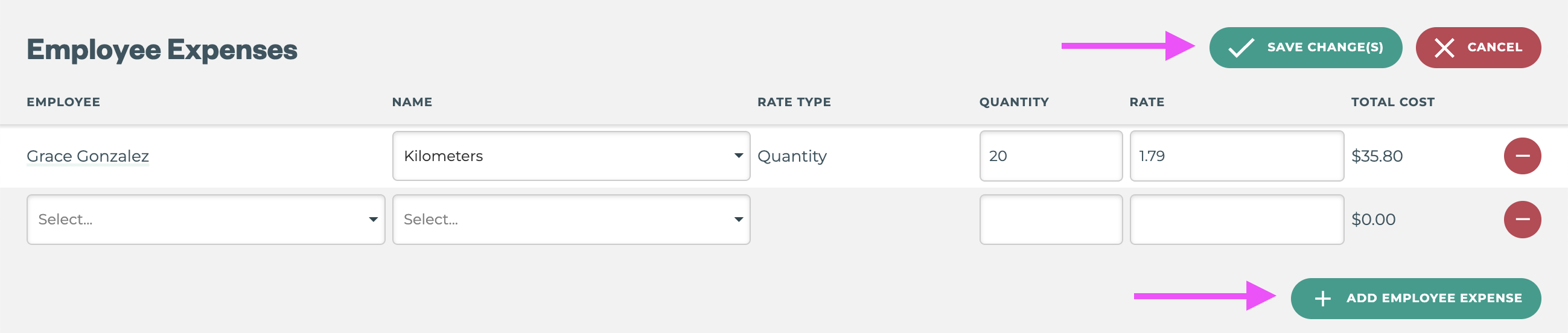

How to…Add Employee Expenses to a Job in Tātou Office

Employee Expenses are located on the Summary Tab of each Job, but are in a separate section to the Timesheet - unlike in Tātou Field App.

Click the + Add Employee Expenses button

Select the Employee from the Employee drop down

Select the Expense Name from the Employee drop down

Enter the Quantity

Check the Rate

Click the Save Change(s) button →

<-

<-

How to…DELETE Employee Expenses from a Job in Tātou Office

Click the Edit Employee Expenses button

Click the Red Delete Icon →

<-

<-Click the Save Change(s) button →

<-

<-

How-To: Pay Employee Expenses

Employee Expenses can be added to Custom Payroll Reports.

Organisations using Xero or Employment Hero Payroll Integrations - this will not be available through the integration in this initial release.

How to…Add Employee Expenses to your Custom Payroll Report

Employee Expenses will be reported on a daily basis in Custom Payroll Reports, but when this feature is turned on users will likely need to add Custom Logic ensure correct coding in their exports.

Employee Expense quantity (units) and rate will be applied to payroll reports, but unless the payroll report has specific columns users will need to use custom logic. For Example:

IF $row_type == timesheet_entry THEN [insert current value type]IF $row_type == employee_expense THEN [select from value types available]ELSE

How to…Add Pay Summary Row Type: Employee Expenses

Pay Summary Row $row_name: employee_expense reports $total value, and will report a value if your report includes a $total column, or custom logic is used to report $total for that specific summary row.

If your report has a $total column:

Click Edit Pay Summary Rows

Click + NEW

Select row type → Employee Expense

Add Summary Row Value(s)

Click Save Change(s)

If your report does NOT have a $total column:

Click Edit Columns

Custom Logic will need to be used to report because the summary row reports the total value of employee expenses reported for the pay period. Example logic:

IF $row_type == summary AND $row_name == employee_expense THEN $totalIF $row_type == summary AND $row_name != employee_expense THEN [insert value type]IF $row_type != summary THEN [insert value type]ELSE

Click Save Change(s)

Click Edit Pay Summary Rows

Click + NEW

Select row type → Employee Expense

Add Summary Row Value(s)

Click Save Change(s)

Always double check Payroll Reports after making any changes to ensure changes accurately match expectations. If you need any help with these changes please reach out to support@tatou.app

Value Changes:

Job Import

The Jobs Import will now distinguish between employee_expense and equipment_expense types

For customers currently using

equipment_expensein Custom Jobs Reports, these values will be updated as part of the release, but may need to be considered in future reports.For customers importing

expenselines in Job Imports, this value will need to be replaced withequipment_expense

employee_expense lines must have matching timesheet_entry lines in order to import.

This includes:

date,leader_staff_id,employee_staff_id,start_time,end_time,unpaid_break_durationsunpaid_break_start_timesrate_type,task,client,locationandblock

Custom Reports and Value Types

Values | Jobs | Payroll | Timesheet | Invoicing |

|---|---|---|---|---|

| ✅ | - | - | - |

| ✅ | - | - | - |

| ✅ | - | - | - |

| ✅ | - | - | - |

| ✅ | - | - | - |

| ✅ | - | - | - |

| - | ✅ | - | - |

| - | ✅ | - | - |

| - | ✅ | - | - |

How-To: Invoice Employee Expenses

Add Default Invoicing Rate to Employee Expenses

Track Employee Expenses

Add Jobs with Employee Expenses to an Invoice

Review Job Costings

Only Employee Expenses with Sales Rates will generate Invoice Lines

Generate Invoice Lines

Select Account

Save and Send Invoice when ready